SEC Meeting in Lincoln is moved from 2-9-19 to 2-16 2019.

AT&T Veterans Discount Program

SEC Meeting

SEC Meeting is Feb 9, 2019 at VFW HQ, 2431 No. 48th St Lincoln , 10:00 AM

AMVETS Nebraska Facebook page

AMVETS Nebraska Facebook page CLICK HERE

Past VFW All American Post Commander and Deputy VAVS Rep for the Omaha VAMC Patrick Peterson passed away.

Just a note to let all of you know that Past All American Post Commander and Deputy VAVS Rep for the Omaha VAMC Patrick Peterson passed away.

His service will be on Saturday at Holy Name Catholic Church at 2901 Fontenelle Blvd. in Omaha at 11:00 am.

There will be a lunch following the service at Post 2503.Details CLICK HERE

Google’s missing moral compass: Tech giant happy to help China but not our US military

Google’s lack of moral compass has crossed the line into endangering the very nation that hosts it and provides the fundamentals for its success.

Full Story CLICK HERE

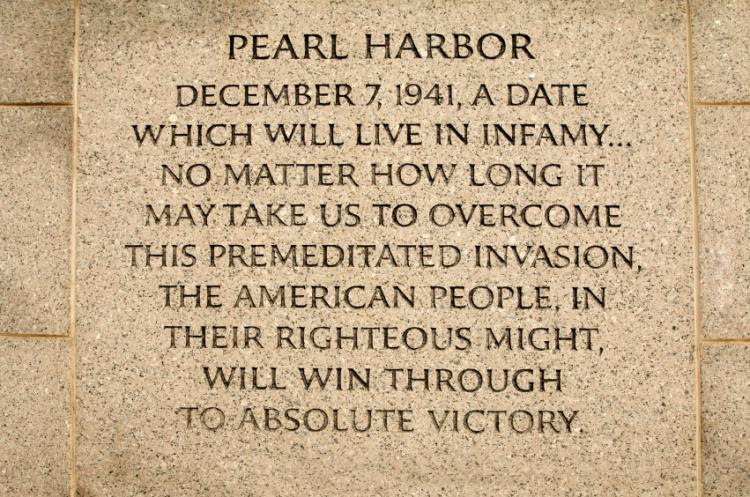

National Pearl Harbor Remembrance Day, which is annually on December 7

National Pearl Harbor Remembrance Day, which is annually on December 7, commemorates the attack on Pearl Harbor, in Hawaii, during World War II. Many American service men and women lost their lives or were injured on December 7, 1941. National Pearl Harbor Remembrance Day is also referred to as Pearl Harbor Remembrance Day or Pearl Harbor Day.

Is Pearl Harbor Remembrance Day a Public Holiday?

Pearl Harbor Remembrance Day is not a public holiday. Businesses have normal opening hours.

Some communities hold special memorial services on Pearl Harbor Remembrance Day.

©iStockphoto.com/JPecha

What Do People Do?

On the direction of the President, the flag of the United States of America should be displayed on the homes of Americans, the White House and all United States government buildings. The flag should be flown at half-mast to honor those who died in the attack on Pearl Harbor.

Many associations, especially those linked with Pearl Harbor survivors or those who died from the attack, participate in special services to commemorate the event. Memorial services are held at venues such as the USS Arizona Memorial in Pearl Harbor. Other activities include: wreath-laying ceremonies; keynote speeches by those associated with the event; luncheons; media stories on survivors’ recollections of the Pearl Harbor attack; and school activities to educate students about the attack on Pearl Harbor in relation to World War II history.

Public Life

Pearl Harbor Remembrance Day is not a federal holiday. Government offices, schools, businesses and other organizations do not close. Public transit systems run on their regular schedules. Some organizations may hold special events in memory of those killed or injured in Pearl Harbor.

Background

On Sunday morning, December 7, 1941, the American Army and Navy base in Pearl Harbor, Hawaii was attacked by the Imperial Japanese Navy. The attack came as a surprise to the American Army and Navy and lead to great losses of life and equipment. More than 2000 American citizens were killed and more than 1000 were injured. The Americans also lost a large proportion of their battle ships and nearly 200 aircraft that were stationed in the Pacific region. More than 60 Japanese servicemen were killed, injured or captured. The Japanese Navy also lost five midget submarines and 29 aircraft.

The Japanese military had hoped that the attack on Pearl Harbor would prevent the United States of America from increasing her influence in the Pacific. However, the events in Pearl Harbor actually led to the escalation of World War II. The day after the attack, the United States declared war on Japan and so entered World War II. President Franklin Roosevelt in a speech to Congress stated that the bombing of Pearl Harbor was “a date which will live in infamy”. Shortly afterwards, Germany also declared war on the United States. In the months that followed the attack, the slogan “Remember Pearl Harbor” swept the United States and radio stations repeatedly played a song of the same name.

In 1991, which marked the 50th anniversary of the attack on Pearl Harbor, the United States Congress established the Pearl Harbor Commemorative Medal. This is also known as the Pearl Harbor Survivor’s Medal and can be awarded to any veteran of the United States military who were present in or around Pearl Harbor during the attack by the Japanese military. The medal can be awarded to civilians, who were killed or injured in the attack.

AMVETS Nebraska Raffle Results

$500.00 raffle winner is James Engbrecht from North Platte.

Legislators from Bellevue seek broader tax exemptions for military retirees

By Steve Liewer / World-Herald staff writer Dec 3, 2018 Updated 11 hrs ago 2

The proposal would broaden an income-tax exemption passed in the Nebraska Legislature in 2014 allowing new retirees to exempt all of their retirement pay from taxes for seven years. Alternatively, at age 67, military retirees could exempt 15 percent of their retirement pay for the rest of their lives.

Blood and Crawford argued that Nebraska is at a disadvantage compared with the states that border it. Wyoming and South Dakota, for example, have no state income tax at all. Iowa, just across the state line from Offutt Air Force Base and Omaha, fully exempts military retirement pay from state income taxes.

When they retire from the military after 20 or more years of service, military retirees draw pay similar to a pension that equals half or more of their military paycheck. Typically the military also will pay to move a retiring service member and his or her family to the place of their choice.

“It’s the job availability, and it’s the schools,” Mikesell said. “Nebraska tends to be towards the top.”

Still, Blood said, the state needs to give retirees every reason to stick around.

Exempting the income of military retirees is a recurring topic in the Legislature, especially among legislators representing Sarpy County, which has a high concentration of military retirees due to its proximity to Offutt.

“They don’t understand the impact Offutt Air Force Base has on the whole state of Nebraska,” she said.

This could be a tough session for the proposal to gain traction. Property tax relief, especially for agricultural landowners, is at the top of the priority list for legislators across the state, and for Gov. Pete Ricketts.

“I don’t know why the Legislature doesn’t understand: ‘you have to spend money to make money,’ ” he said.

Blood said she agreed with the goal but supports going after it in smaller steps.

“We have to start somewhere,” she said.

AMVETS Nebraska has a new Facebook page

New Facebook page CLICK HERE